2025 Tax Rates Married Filing Jointly Over 65

2025 Tax Rates Married Filing Jointly Over 65. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing. 2025 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households

To figure out your tax bracket, first look at the rates for the filing status you plan to use: Explore the 2025 federal income tax brackets and rates.

2025 Standard Tax Deduction Married Jointly For Senior Citizens Dasha, As your income goes up, the tax rate on the next layer of income is higher.

Tax Brackets 2025 Married Filing Jointly Over 65 Delly Fayette, For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for joint.

Tax Brackets 2025 Married Jointly Over 65 Alvina Shaina, These rates will remain the same until 2025 as a result of the tax cuts and jobs act of 2017.

Tax Brackets 2025 Married Filing Jointly Over 65 Delly Fayette, Your average tax rate is 10.94%.

Tax Brackets 2025 Married Jointly Over 65 Issie Sydney, In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).

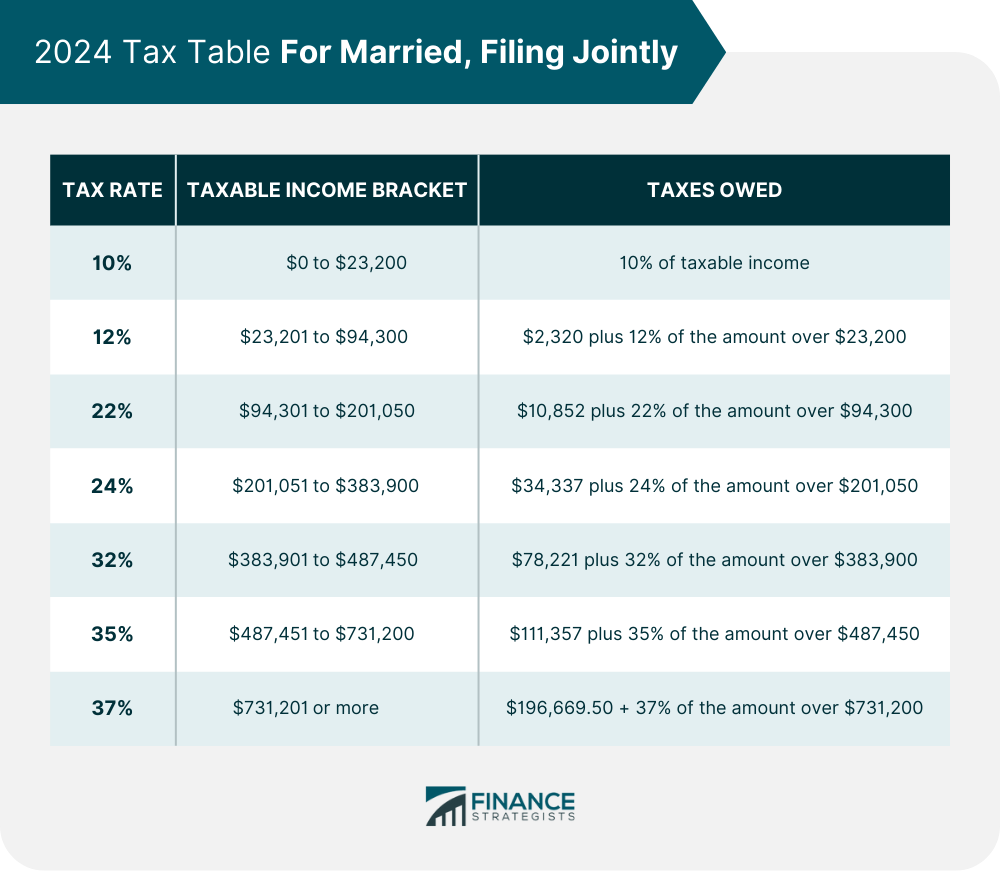

Tax Brackets Definition, Types, How They Work, 2025 Rates, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, You pay tax as a percentage of your income in layers called tax brackets.

2025 Standard Tax Deduction Married Jointly For Senior Citizens Dasha, For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for joint.

2025 Tax Brackets Married Filing Jointly Over 65 Jeana Lorelei, The tax rate for couples (joint filing) earning under $450k will be preserved.