2025 Income Tax Brackets Head Of Household

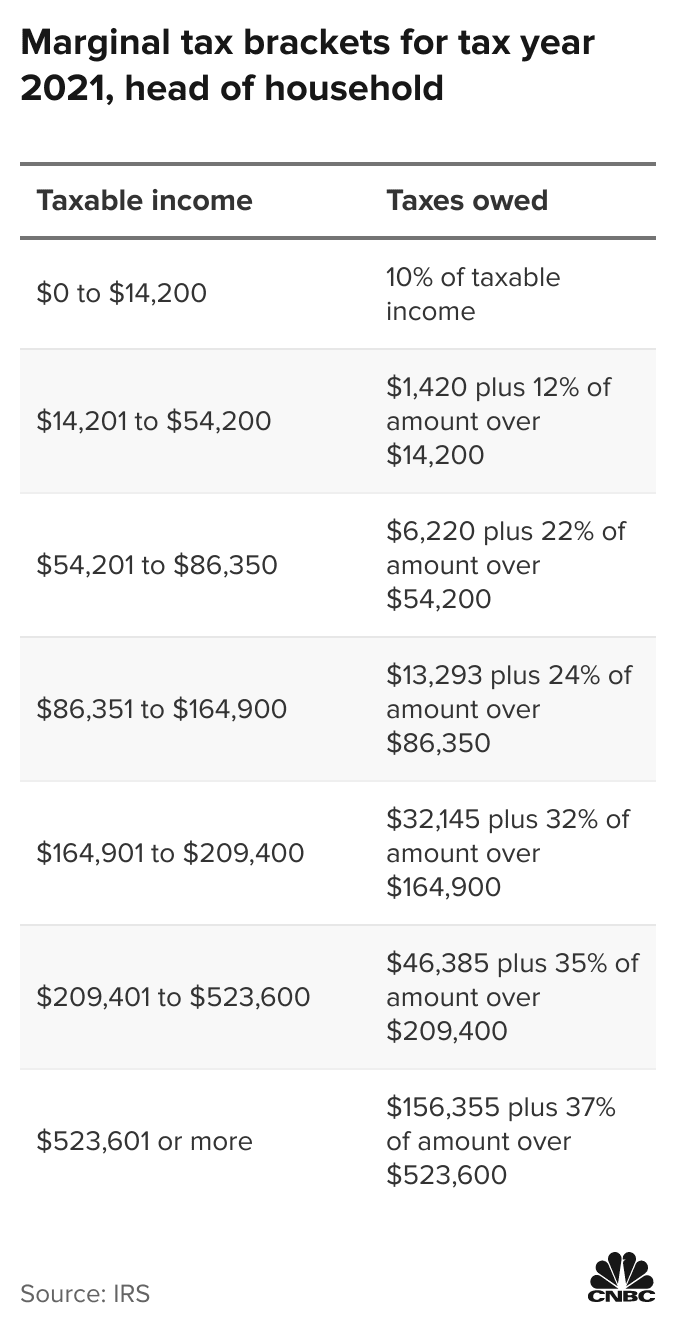

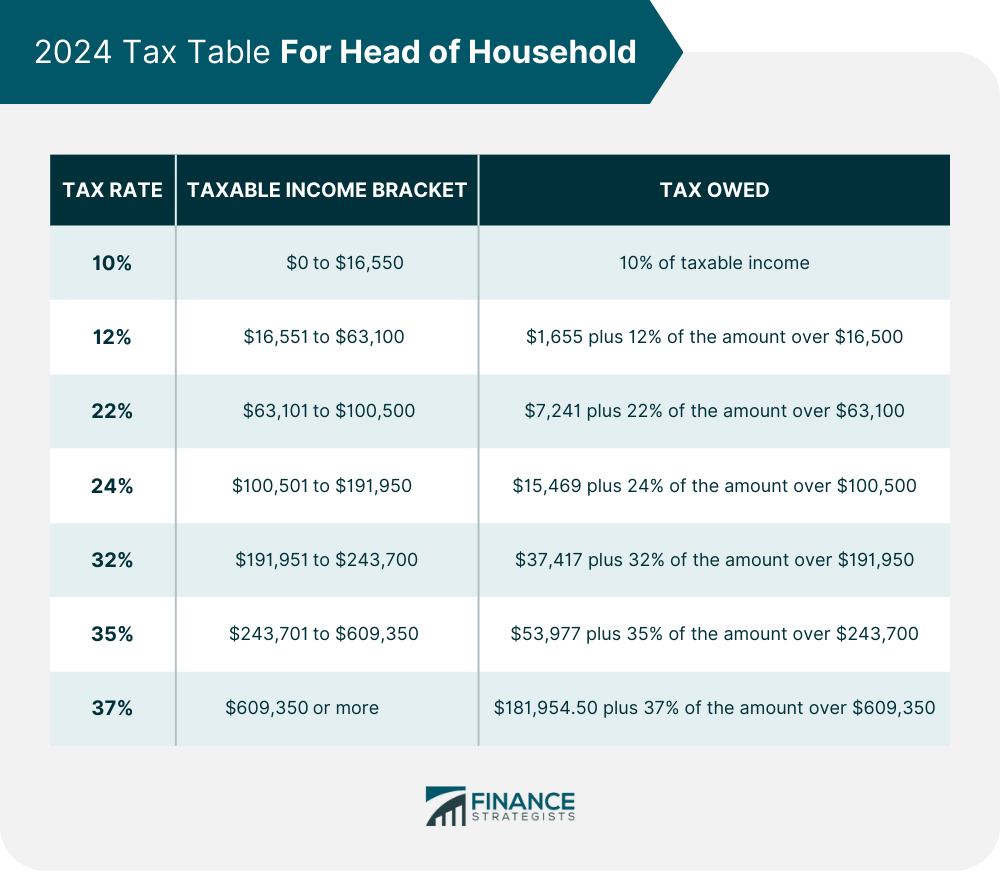

2025 Income Tax Brackets Head Of Household. The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

There are five main filing statuses: Single filers hit the 12% bracket with $11,600 in income in 2025.

2025 Tax Brackets Head Of Household Calculator Marji Shannah, The tax brackets are wider for people who file as head of household.

Tax Brackets Definition, Types, How They Work, 2025 Rates, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Irs Tax Bracket 2025 Head Of Household Chanda Kyrstin, To see the 2025 head of household tax brackets and rates, use a tax bracket calculator.

Tax Calculator 2025 With Dependents Irena Saloma, See an overview and example on how tax brackets and rates are.

Tax Brackets 2025 Head Of Household 2 Dependents Addi Livvyy, There are seven federal tax brackets for tax year 2025.

Tax Brackets For 2025 Head Of Household Bria Marlyn, There are seven federal tax brackets for tax year 2025.

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

Tax Brackets For 2025 Head Of Household Single Cher Melany, United states (us) tax brackets calculator.

Tax Brackets 2025 Head Of Household Corri Doralin, Married couples filing separately and head of household filers;

Winter Solstice 2025 Countdown. How many days left until winter solstice 2025? The next winter […]

Fifa 2025 Apkcombo. Join us in celebrating ea sports fc™ mobile’s 1st anniversary update! Use […]